All Categories

Featured

Table of Contents

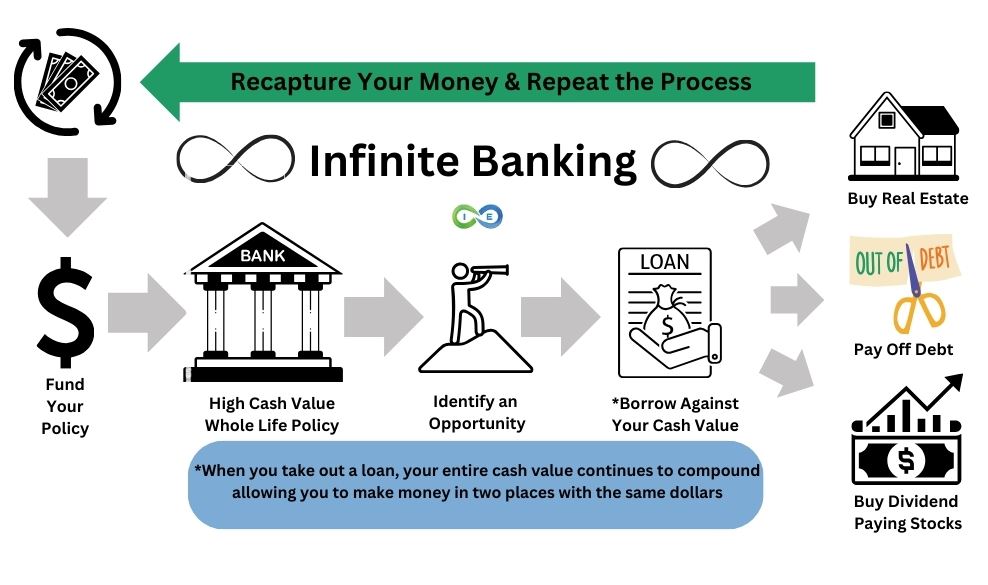

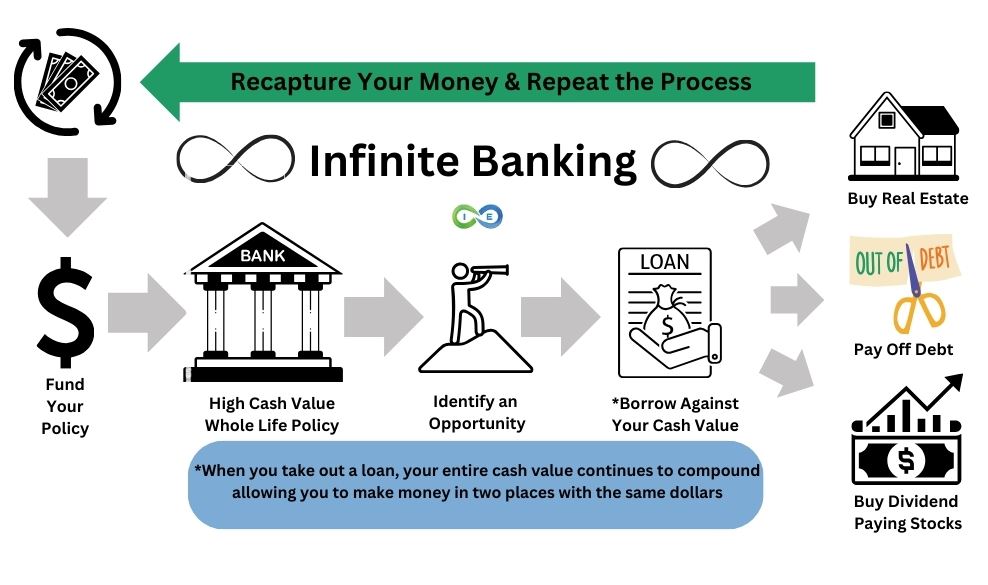

For many people, the biggest trouble with the limitless financial concept is that preliminary hit to early liquidity caused by the expenses. Although this disadvantage of boundless banking can be reduced significantly with proper plan style, the first years will constantly be the worst years with any type of Whole Life policy.

That said, there are particular infinite financial life insurance coverage policies made mainly for high early money worth (HECV) of over 90% in the initial year. Nonetheless, the lasting performance will typically considerably lag the best-performing Infinite Financial life insurance policy policies. Having access to that additional 4 figures in the initial couple of years might come with the price of 6-figures later on.

You actually get some significant lasting advantages that aid you recoup these very early prices and after that some. We discover that this impeded very early liquidity trouble with infinite financial is much more mental than anything else when thoroughly discovered. If they definitely needed every dime of the money missing out on from their limitless banking life insurance coverage policy in the initial couple of years.

Tag: limitless banking principle In this episode, I talk regarding funds with Mary Jo Irmen who shows the Infinite Financial Concept. With the rise of TikTok as an information-sharing system, monetary guidance and techniques have found a novel way of dispersing. One such approach that has actually been making the rounds is the unlimited financial concept, or IBC for short, gathering endorsements from celebs like rapper Waka Flocka Flame.

Within these policies, the cash money value grows based on a rate established by the insurance firm. Once a significant cash money worth gathers, insurance holders can get a cash value car loan. These fundings differ from traditional ones, with life insurance functioning as collateral, implying one can shed their protection if loaning exceedingly without adequate money worth to support the insurance coverage prices.

And while the appeal of these policies appears, there are natural constraints and risks, necessitating persistent cash money worth monitoring. The method's legitimacy isn't black and white. For high-net-worth individuals or service owners, particularly those utilizing approaches like company-owned life insurance coverage (COLI), the benefits of tax breaks and compound development could be appealing.

Rbc Visa Infinite Avion Online Banking

The appeal of limitless banking does not negate its challenges: Expense: The foundational need, an irreversible life insurance coverage policy, is pricier than its term counterparts. Qualification: Not everyone gets whole life insurance policy as a result of extensive underwriting procedures that can omit those with certain wellness or way of life problems. Complexity and risk: The complex nature of IBC, coupled with its threats, may discourage several, particularly when less complex and much less risky options are readily available.

Alloting around 10% of your month-to-month revenue to the policy is just not possible for many individuals. Part of what you review below is simply a reiteration of what has currently been said over.

Before you obtain yourself into a circumstance you're not prepared for, know the adhering to first: Although the principle is frequently sold as such, you're not actually taking a lending from yourself. If that were the situation, you wouldn't need to repay it. Rather, you're borrowing from the insurer and have to settle it with interest.

Some social media posts suggest using cash money worth from entire life insurance to pay down credit history card debt. When you pay back the finance, a section of that rate of interest goes to the insurance company.

For the first numerous years, you'll be paying off the payment. This makes it extremely hard for your plan to collect value throughout this time. Unless you can pay for to pay a few to numerous hundred bucks for the following decade or even more, IBC will not function for you.

Bank Of China Visa Infinite Card

Not everyone should rely only on themselves for financial security. If you call for life insurance coverage, here are some beneficial pointers to think about: Think about term life insurance policy. These policies supply protection throughout years with considerable monetary commitments, like mortgages, trainee loans, or when taking care of young children. Make certain to search for the very best price.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Name "Montserrat". This Typeface Software application is accredited under the SIL Open Font Style License, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Name "Montserrat". This Typeface Software is certified under the SIL Open Font Style Permit, Version 1.1.Miss to main content

Infinite Banking Calculator

As a CPA specializing in property investing, I've combed shoulders with the "Infinite Financial Principle" (IBC) much more times than I can count. I've also interviewed specialists on the topic. The major draw, apart from the evident life insurance policy advantages, was constantly the idea of accumulating cash money worth within an irreversible life insurance policy policy and loaning versus it.

Certain, that makes sense. However honestly, I always assumed that cash would be better spent straight on financial investments instead than funneling it via a life insurance policy plan Until I found how IBC can be combined with an Irrevocable Life Insurance Depend On (ILIT) to produce generational riches. Let's begin with the basics.

Infinite Banking Concept Uk

When you obtain versus your policy's cash money value, there's no collection repayment timetable, offering you the flexibility to handle the lending on your terms. On the other hand, the money value remains to grow based on the plan's warranties and returns. This arrangement permits you to accessibility liquidity without interrupting the long-lasting growth of your policy, gave that the financing and passion are handled wisely.

As grandchildren are birthed and grow up, the ILIT can buy life insurance policy plans on their lives. Household participants can take lendings from the ILIT, utilizing the cash money worth of the policies to fund investments, begin businesses, or cover significant costs.

A crucial aspect of managing this Household Bank is making use of the HEMS standard, which means "Health, Education, Upkeep, or Assistance." This standard is commonly included in depend on arrangements to direct the trustee on how they can disperse funds to recipients. By adhering to the HEMS criterion, the depend on makes sure that circulations are created essential demands and long-lasting support, safeguarding the trust's properties while still giving for member of the family.

Boosted Versatility: Unlike stiff small business loan, you control the settlement terms when obtaining from your very own plan. This enables you to structure repayments in a means that lines up with your service capital. specially designed life insurance. Improved Cash Money Circulation: By funding overhead via plan finances, you can potentially liberate cash that would or else be bound in conventional financing repayments or tools leases

He has the same devices, yet has also built extra money value in his policy and obtained tax obligation advantages. And also, he currently has $50,000 available in his policy to utilize for future chances or costs. Despite its possible benefits, some individuals continue to be hesitant of the Infinite Financial Idea. Allow's resolve a few usual worries: "Isn't this simply expensive life insurance policy?" While it's real that the premiums for an appropriately structured entire life policy may be more than term insurance, it is essential to view it as even more than simply life insurance policy.

Infinite Financial Group

It's about developing an adaptable funding system that gives you control and supplies several benefits. When made use of purposefully, it can enhance various other financial investments and organization approaches. If you're intrigued by the potential of the Infinite Financial Idea for your business, right here are some actions to consider: Inform Yourself: Dive deeper into the concept via reliable publications, workshops, or appointments with experienced experts.

Table of Contents

Latest Posts

Infinite Bank Statements

Does Infinite Banking Work

Royal Bank Visa Infinite Avion

More

Latest Posts

Infinite Bank Statements

Does Infinite Banking Work

Royal Bank Visa Infinite Avion