All Categories

Featured

Table of Contents

The are entire life insurance policy and global life insurance coverage. The cash money worth is not included to the fatality advantage.

The policy finance interest price is 6%. Going this route, the rate of interest he pays goes back into his policy's cash money worth rather of an economic institution.

Banker Life Quotes

Nash was a money professional and follower of the Austrian college of business economics, which advocates that the value of goods aren't clearly the result of traditional financial frameworks like supply and need. Rather, people value cash and goods in a different way based on their economic condition and needs.

Among the risks of typical financial, according to Nash, was high-interest prices on lendings. Way too many people, himself included, entered into monetary problem as a result of reliance on financial institutions. Long as banks established the rate of interest prices and lending terms, individuals really did not have control over their own wide range. Becoming your own banker, Nash determined, would put you in control over your monetary future.

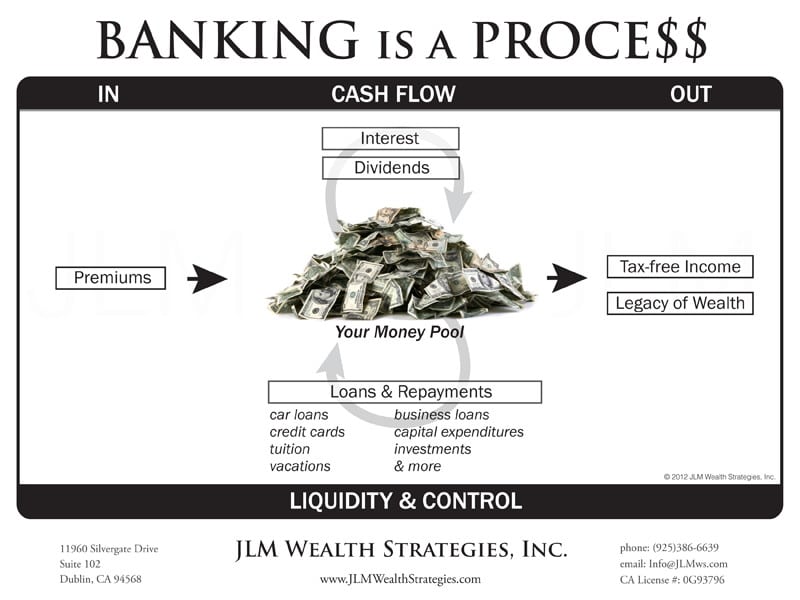

Infinite Financial needs you to possess your financial future. For goal-oriented people, it can be the most effective financial device ever. Below are the advantages of Infinite Banking: Arguably the single most valuable facet of Infinite Financial is that it boosts your money flow. You don't require to go with the hoops of a conventional bank to obtain a finance; merely request a policy loan from your life insurance policy business and funds will certainly be provided to you.

Dividend-paying entire life insurance policy is extremely reduced risk and uses you, the insurance policy holder, a great offer of control. The control that Infinite Financial supplies can best be organized right into two categories: tax benefits and property securities.

Infinite Banking With Whole Life Insurance

When you utilize whole life insurance for Infinite Banking, you get in right into an exclusive contract between you and your insurance coverage business. These protections might vary from state to state, they can consist of security from possession searches and seizures, security from judgements and security from lenders.

Whole life insurance policy plans are non-correlated assets. This is why they function so well as the economic foundation of Infinite Banking. Regardless of what takes place on the market (stock, property, or otherwise), your insurance plan preserves its worth. A lot of people are missing this important volatility buffer that aids safeguard and grow riches, rather breaking their cash right into two containers: checking account and investments.

Whole life insurance policy is that 3rd container. Not just is the rate of return on your whole life insurance policy ensured, your death advantage and premiums are likewise ensured.

This framework aligns perfectly with the concepts of the Perpetual Riches Strategy. Infinite Financial appeals to those looking for greater monetary control. Right here are its major benefits: Liquidity and ease of access: Policy financings supply prompt access to funds without the limitations of traditional small business loan. Tax performance: The cash value expands tax-deferred, and plan finances are tax-free, making it a tax-efficient tool for constructing wide range.

How To Set Up Infinite Banking

Property defense: In many states, the cash money worth of life insurance coverage is secured from lenders, adding an extra layer of monetary security. While Infinite Banking has its qualities, it isn't a one-size-fits-all service, and it comes with substantial drawbacks. Here's why it may not be the most effective strategy: Infinite Financial commonly requires elaborate policy structuring, which can puzzle policyholders.

Envision never ever needing to fret about financial institution financings or high rate of interest again. What happens if you could borrow money on your terms and build wealth concurrently? That's the power of infinite banking life insurance policy. By leveraging the money value of entire life insurance policy IUL plans, you can grow your wealth and obtain money without relying upon standard banks.

There's no set loan term, and you have the liberty to select the settlement routine, which can be as leisurely as paying back the financing at the time of death. This flexibility includes the maintenance of the loans, where you can decide for interest-only settlements, keeping the car loan balance flat and workable.

Holding cash in an IUL dealt with account being credited rate of interest can frequently be far better than holding the money on deposit at a bank.: You've constantly imagined opening your very own bakeshop. You can borrow from your IUL plan to cover the first expenses of renting an area, acquiring tools, and working with team.

Infinite Banking Think Tank

Individual car loans can be obtained from standard financial institutions and credit score unions. Obtaining cash on a credit scores card is generally extremely expensive with yearly percentage prices of passion (APR) usually reaching 20% to 30% or more a year.

The tax therapy of plan fundings can vary considerably depending on your nation of home and the details regards to your IUL plan. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy financings are normally tax-free, supplying a significant benefit. In various other jurisdictions, there might be tax ramifications to consider, such as possible tax obligations on the finance.

Term life insurance just provides a survivor benefit, without any kind of money value buildup. This indicates there's no cash money value to obtain against. This article is authored by Carlton Crabbe, Ceo of Resources permanently, an expert in giving indexed universal life insurance policy accounts. The information offered in this short article is for instructional and informational objectives only and ought to not be taken as economic or investment guidance.

Nevertheless, for lending officers, the substantial laws imposed by the CFPB can be seen as difficult and restrictive. Initially, finance policemans often say that the CFPB's guidelines create unnecessary red tape, leading to even more paperwork and slower funding handling. Rules like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) needs, while targeted at shielding customers, can bring about hold-ups in shutting offers and raised operational prices.

Latest Posts

Infinite Bank Statements

Does Infinite Banking Work

Royal Bank Visa Infinite Avion